October 4, 2012

Contact: Alia Faraj-Johnson

850-222-1996

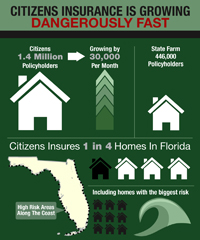

Tallahassee – Business leaders, lawmakers, industry representatives, and a consumer advocate today urged the Board of Governors of Citizens Property Insurance Corporation (Citizens) to act with all due haste in passing the Surplus Note Depopulation Program (SND Program). The Citizens Board is considering the SND Program to transfer approximately 300,000 policies from Citizens by private-market insurers.

Associated Industries of Florida President Tom Feeney said, “Citizens is bursting at the seams with close to 1.5 million policies. We are one big hurricane away from socking Floridians and our businesses with a crushing $3 billion hurricane tax; this program can reduce that threat.”

The goal of the program, slated to start in December, is to reduce Citizens' claims liability from a large storm or series of storms. It would reduce the potential for hurricane taxes on all types of insurance policies on all Floridians. The plan will reduce Citizens assessment risk by approximately $1.2 billion. In the event of a major storm, the possibility of an emergency hurricane tax being levied on Floridians would be reduced by 38 percent.

The goal of the program, slated to start in December, is to reduce Citizens' claims liability from a large storm or series of storms. It would reduce the potential for hurricane taxes on all types of insurance policies on all Floridians. The plan will reduce Citizens assessment risk by approximately $1.2 billion. In the event of a major storm, the possibility of an emergency hurricane tax being levied on Floridians would be reduced by 38 percent.

Sen. John Thrasher, of Jacksonville, said, “Those who are calling for delays in this program are playing poker with Florida’s economy and Floridian’s wallets. We have dodged the hurricane bullet for a while, but we cannot enter another hurricane season exposed to fiscal catastrophe.”

Citizens will provide the upfront capital, estimated to be $350 million, in the form of 20-year loans, to support the assumption of large blocks of Citizens' personal residential policies by qualifying insurers. Citizens estimates that as many as 300,000 policies could be removed under the new program.

“Unfortunately, state policy has created this insurance monster,” said Bryan Nelson, Chairman of the House Insurance and Banking Committee. “And while we work to correct these policies, we have a brilliant plan to largely fix the problem, and we must not delay and watch it fall apart.”

To reduce Citizens catastrophic risk by the same amount as the $350 million in onetime loans, Citizens would have to purchase an estimated $240 in reinsurance coverage. And that coverage would only be good for one year and the money spent on it would be gone.

Citizens developed the program after soliciting depopulation ideas from private insurance companies. The plan was first presented in April and has been discussed and testified on various times around the state.

Hurricane taxes on non Citizens policyholders could reach 32% of their annual premium for one year. That tax could be as high as 45% for Citizens policyholders. The average per policy premium in Citizens is $2,269. Therefore a customer who is removed from Citizens could avoid the first round of Citizen policyholder assessments in the event of a 1 in 100 year storm, effectively avoiding a hurricane tax that could reach $1021.

If these taxes do not cover the deficit in Citizens reserves, all property insurance policyholders could be taxed up to 30% of their premium for as many years as it takes to cover the deficit. Hurricane taxes can also be imposed on other insurance policies and also by the Florida Hurricane Catastrophe Fund.

“Florida’s insurance agents are ready to help bring this novel program to the people and educate them on its great provisions,” said Dave Newell, Director of Education for the Florida Association of Independent Insurance Agents. “Citizens should be applauded for embracing such a forward thinking plan.”

Companies wanting to participate must meet strict financial requirements -- much stricter than what OIR requires of property insurers seeking licensure. Participating insurers are extremely limited as to how they can use surplus note loan funds. Companies that fail to meet program requirements face strict penalties.

Walter Dartland, President of the Consumer Federation of the Southeast, said, “I have studied this program, and I have spoken extensively with Citizens President Barry Gilway and CFO Sharon Binnun. We have to reduce the extreme liability that Floridians face in assessments and taxes when the wind finally does blow upon our state. This program can do that, while at the same time respecting Citizens surplus and reserves.”

The program includes many consumer protections including:

A meeting scheduled for next Tuesday in Orlando will allow significant additional public testimony on the proposal.